Awesome! This Money Transfer Method = 75% Lower Fees [NEW]

Today I'm going to show you how I managed to save 75% in fees and commissions on all my international money transfers.

It's much easier than you think.

In fact, I'm going to explain the exact steps that saved me $627 in money transfer fees last year.

Now it's time to show you how (Spoiler ahead: There’s an App for That!).

Table of Contents

But before I share it with you:

Let's see first how money transfer worked before Fintech disruptors came in.

What is the first thing that comes to your mind in terms of a money transfer service?

Probably Western Union or MoneyGram?

Actually, I quit using those big names after I accidentally stumbled upon this unique online money transfer service backed by Mastercard and Visa.

More about that later.

A common thing for all those established players like WU or MoneyGram is that they all have brick and mortar outlets. Or they partner with local exchange and post offices.

In any case, those are all real outlets with real people sitting in there, working during regular business hours.

What does it mean?

For example, I can do a money transfer on Monday at 10 am, but I cannot do it on Sunday at 10 pm, because they are closed.

It also means that they are going to charge me with a hefty fee on that money transfer because they need to pay for all the resources. Renting equipment and outlet costs money, and people sitting there also cost money.

This is the truth about money transfer service:

Companies with brick and mortar outlets have substantial operating costs, so they have to charge you with massive commissions only to pay their bills and stay in business.

Today nearly $80 trillion (US) of money is sent via a wire transfer or bank account globally. Still, the process is inefficient, outdated, costly, and more complicated than it should be. Money can take days to arrive.

Banks are buried under legacy systems that are slow, expensive, and not user-friendly. Additionally, many people are still unaware of what's possible digitally.

Walking around New York, I often see people queuing at the various old-school money transfer providers, to send or receive money from abroad.

Considering that most people in these queues have physical cash on them, it's not very safe or convenient.

And guess what?

These people are charged in the form of a bad retail exchange rate and a service fee.

It's expensive.

So if you want to send money faster, for a low flat fee without even leaving your home, you'll love the actionable strategies I am sharing in today's post.

Besides avoiding hefty fees, I will also show you how to initiate online money transfer directly from your credit/debit card to another card or bank account, thanks to MasterCard send and Visa Direct services.

Keep reading...

How do I transfer money to someone else's bank account?

Thanks to rapidly adapting fintech firms, you can send money online to any MasterCard, Visa, UnionPay, or a regular bank account from your mobile phone.

You don't even need to know what is your bank's routing number.

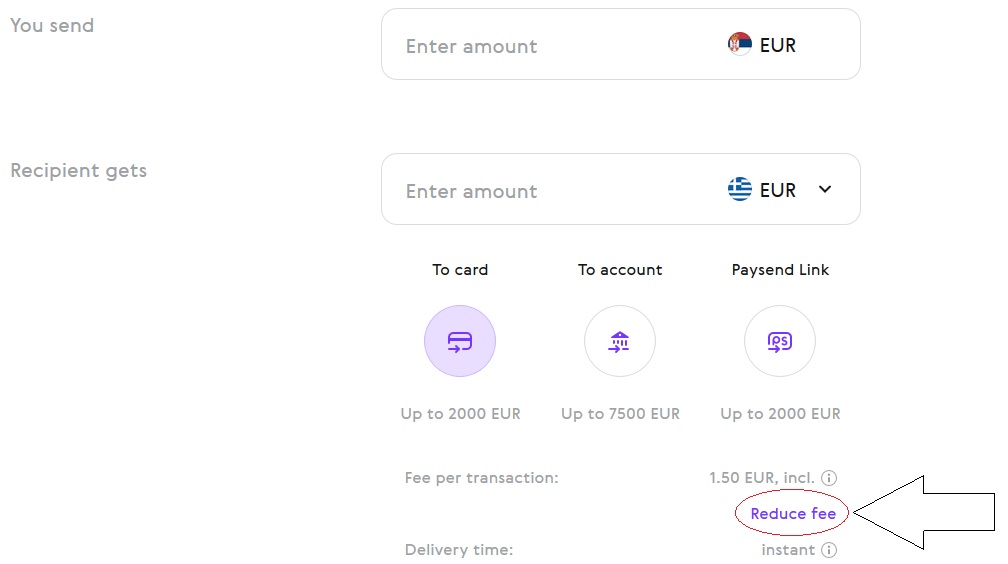

The transfer is secure, instant (up to 3 business days), and it will cost you a fixed fee of:

- 1.5 € for transfers from the Eurozone;

- £1 for transfers from the UK;

- $2 from the USA.

Note: The money transfer fee is fixed only for the amounts up to 150 € or $200. Above that amount, the commission is 1% of the transferred amount.

How can I send money fast for a low fee?

If you ever have to transfer cash across borders, I'd 100% recommend PaySend.com - they provide fast transfer, lower fees than the bank + zero hassle.

I am going to show you how to do it, step by step:

You can register on paysend.com using only your cell phone number.

Follow the steps to complete the registration process, and you're ready to make your first money transfer.

But wait, there's more:

You can also send a "no fee money transfer."

Enter Paysend promo code (invite code) 0105lf when making your first transfer with Paysend, and get your first money transfer done without any cost.

Your money transfer fee will be completely waved for the first transfer. All you need to do is to click the "Reduce fee" link on the "new transfer" screen and enter 0105lf in the Promo Code field.

What is the best app for transferring money?

Did I mention that paysend.com also has an Android app and an iPhone app?

Enjoy your cheap and effortless bank transfers, and do let me know your feedback in the comments below.

Source of information used in this post: